Take Control Of Your Future Today

We tap into the intellectual capital of leading investment voices as well as highly specialized boutiques.

Our holistic approach covers both sides of your balance sheet with no limit on the solutions you can choose.

Since we work with a select number of clients, we offer an unparalleled level of customer service and attention.

As an independent fiduciary, we can offer virtually any investment from major Wall Street firms to specialized boutique offerings.

We access industry-leading, cloud-based technologies to identify solutions for your path forward.

The safekeeping of your assets is our top priority. To custody your assets, we’ve chosen Charles Schwab – – 50 years of experience with $8 trillion in custody assets.

Wealth Alliance Global is an independent wealth management firm dedicated to helping high net worth clients achieve a worry free, no compromise retirement and build a lasting legacy for the future.

We bring all our expertise together – from financial planning to portfolio management to estate planning – to help you start your financial journey – staying right alongside you with our platinum level of service.

Contact us today to prepare for your best possible tomorrow.

Buy And Monitor

Choose an investment plan that suits you and track your growth in real time.

Investment Portfolios

Definition

Investment Calculator

Price Range

Portfolio Information

About Us

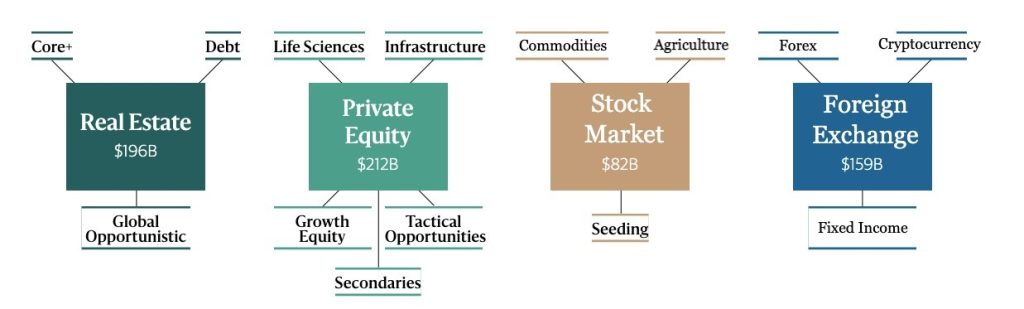

At Arlington Capital Partners, we provide multidimensional strategies that align capital with opportunity, protect legacy, and adapt across life stages. Each pillar is a flexible, client-driven platform, engineered to serve evolving financial realities with intelligence and precision.

Mission Statement

Arlington Capital Partners is an independent wealth and investment management firm dedicated to helping accomplished individuals and families strategically preserve, grow, and transfer wealth across generations.

Through a disciplined, client-first approach, we deliver bespoke financial planning, open-architecture investment solutions, and advanced capital strategies tailored to each client’s goals, risk tolerance, and life transitions.

As pioneers at the intersection of innovation and legacy, we provide access to a global landscape of opportunities — from traditional equities and estate planning to alternative assets like Bitcoin, algorithmic FX, and emerging technologies — while serving as trusted stewards of long-term financial success.

Vision Statement

To lead the future of independent wealth and investment management by setting a new standard for how successful people navigate innovation, protect legacy, and achieve enduring prosperity.

We envision a world where capital is managed with foresight, freedom, and integrity — free from corporate constraints, deeply aligned with client values, and built to adapt across industries, economies, and generations.

Our goal is to be the premier destination for investors who expect both sophisticated financial management and meaningful human advice in an increasingly complex, opportunity-rich world.

Market Updates

Services / What We Do

📊 Strategic Wealth Planning

Precision Planning

Lifelong Adaptability

Advanced cash flow and retirement modeling

Tax-aware accumulation and decumulation

Risk management and contingency design

Liquidity mapping across personal and business capital

📈 Investment Management

Open Architecture Meets Innovation Access

Strategic equity allocation with a tilt toward AI, robotics, cloud, and biotech

Managed accounts or pooled structures (future fund model)

ESG and values-based integration

Intelligent analytics and AI-supported rebalancing

🏦 Advanced Capital Strategies

Solutions for Complex Capital

Long-term Bitcoin holdings and active yield strategies (staking, DeFi, wrapped assets)

Private placements, pre-IPO equity, and venture access

Algorithmic FX, yield-enhancement, and digital strategy

Secure custody, reporting, and estate planning integration

⚙ Algorithmic FX & Automated Yield

High-Speed, Rules-Based Capital Deployment

Expert Advisor (EA) systems and AI-driven models

Capital deployment in internal or client-directed accounts

Performance dashboards and live analytics

Roadmap for copy-trading or FX-focused fund offering

🏛 Legacy & Estate Architecture

Preserving Wealth with Purpose

Trust design and estate tax optimization

Philanthropic strategy and foundation structuring

Succession planning and family governance

Cross-border estate coordination and asset protection

💧 Liquidity & Event Planning

Foresight for Pivotal Transitions

Business exits and liquidity event planning

Equity compensation, RSUs, and deferred income

Asset transfers and recapitalizations

Post-liquidity reinvestment and lifestyle strategy

Asset Management

We create customized, integrated investment solutions to meet the unique needs of insurers and pension plans.

Institutional Management

When you select Arlington Capital Partners to manage institutional assets, you will discover why we’ve earned the reputation for solid performance and equally solid relationships.

WEALTH Management

Your financial goals are uniquely your own, so Arlington Capital Partners will design a wealth management strategy that’s just for you.

Our advisors connect your finances to what you want out of life and create a plan designed to make it happen, revealing possibilities while protecting you from the unexpected—today and every day after.

A personalized plan that brings all aspects of your financial life together

A strategic mix of insurance and investments working together for your goals

Your go-to financial expert who helps keep your big picture, and dreams, in focus

As a catalyst for shared prosperity and a better future,

we strive to lead the alternative investment industry, both in terms of generating returns and make a lasting positive impact. Our growth in becoming one of the largest alternative investment managers is aligned with this vision and is a testament to our shared values, experienced management team, and focus on performance and high-quality investor base, which includes large asset management , trading , Infrastructures, sovereign wealth funds and financial planning.

Sectors

Private Equity

Private equity funds typically invest in equity capital that is not quoted…

Sectors

REAL ESTATE

As one of the world’s largest investors in real estate, we own and operate iconic properties in the world’s most dynamic markets…

Sectors

Foreign Exchange

Arlington Capital Partners finance offers a broad array of professional services and access to the global foreign exchange …

Investor Relations

Arlington Capital Partners provides advanced investment strategies and wealth management solutions to forward-thinking investors around the world. Through its distinct investment brands Arlington Capital Partners Management, we offers a diversity of investment approaches, encompassing bottom-up fundamental active management, Responsible Investing, systematic investing and customized implementation of client-specified portfolio exposures. Exemplary service, timely innovation and attractive returns across market cycles have been hallmarks of Arlington Capital Partners since the origin.

Our Diversity & Inclusion Strategy

At Arlington Capital Partners, we want every person to have the opportunity to succeed based on merit, regardless of race, color, religion, creed, ancestry, national origin, sex, age, disability, marital status, citizenship status, sexual orientation, gender identity expression, military or veteran status, or any other criterion. Why is this so important? To us, diverse and inclusive teams enriched with people of distinctive backgrounds make us better. They help us generate better ideas, reach more balanced decisions, engage our communities and help our clients achieve better outcomes.

FINANCIAL PLANNING

These days, it’s more important than ever to have a plan. Our version of financial planning not only gives you the confidence to know you’re ready for anything, but is also designed to help you reach all your goals in the days ahead.

Investment Philosophy

Arlington Capital Partners differentiated credit-focused franchise combines relative value trading with a deep understanding of fundamental credit investing and legal and structuring expertise. With an emphasis on risk management, Arlington Capital Partners opportunistically invests across the capital structure in less efficient segments of the market with the goal of generating consistent, alpha-driven returns across market cycles.

FOCUS

We are focused on global investment strategy. We generally seek to build a concentrated portfolio of scale investments in industries we know well and have developed significant expertise

Culture of transparency

We believe in sharing good (and bad) news early, aligning ourselves with our investors and companies, and truly partnering and empowering management teams. We also don’t charge transaction or monitoring fees to our portfolio companies (and haven’t since our founding)

Commitment to making companies better

We invest for the long haul to support the strategic and financial objectives of outstanding management teams. We believe our deep sector experience allows us to add value and offer insights that enable our companies to flourish.

Industry Insights

Our investment philosophy is enhanced further by the depth of our focus on industry verticals. We have distinguished ourselves as a value-added partner with deep sector insights in select verticals which enables us to take a differentiated approach to sourcing, diligence, and value creation initiatives

Demonstrated performance

We have a clear investment philosophy and disciplined approach to investing and have demonstrated performance across multiple investment cycles over our 10 years history

Responsible Investing

Arlington Capital Partners is committed to conducting business in a safe, responsible, and ethical manner. These principals guide our decision-making throughout the investment lifecycle.

From the onset of the investment process, we pursue ideas inspired by environmental, social, and governance (‘ESG’) issues and participate in industries engaged with these themes. All companies in which we invest are first vetted by our professionals, who work closely with expert advisors, to identify and mitigate potential ESG conflicts. Our ESG due diligence program requires an assessment of ten key ESG areas which may impact the current or future performance of a company. One Equity Partners will forego any investment that fails to meet its ESG standards.

Once invested, One Equity Partners reviews and monitors all its portfolio companies to ensure they adhere to its ESG policy, which is periodically reviewed to incorporate best practices as risks evolve. This process allows One Equity Partners to quickly detect and preempt or manage any difficulties that may arise during the investment period.

As investments mature, One Equity Partners seeks to continually improve upon ESG reviews and recommendations, and, together with management, works to ensure that ESG issues are prioritized through to and beyond exit.

Professionally managed investment portfolios

Time is a precious commodity. Researching investments in ever-changing markets and handling investment transactions are more than most people have time for. Arlington Capital Partners Asset Management Solutions program allows you to delegate the daily management of your assets and invest with confidence, knowing that your portfolio is in the hands of experienced professionals.

Different goals require different approaches.

At Arlington Capital Partners we recognize that each investor is unique. That’s why we take a personalized approach to developing an asset management strategy by selecting investment portfolios that closely match your goals, tolerance for risk, and expectation for returns.

To provide you additional value, we strive to:

- Create opportunities for rewards while managing risk.

- Minimize management and administrative costs.

- Provide ongoing services that adapt to changes in your goals.

wealth planning

A solid Wealth Plan ensures you have a financial strategy that supports your aspirations. Once we understand your lifestyle goals, we look at the current path of your finances to ensure that you are on track to meet them through retirement and beyond.

EXPERTISE ACROSS A WIDE

RANGE OF STRATEGIES

Renewable power for a cleaner, brighter tomorrow

What we do

Analyze the sustainability of your wealth through retirement and beyond

Understand the risks you may be exposed to and identify strategies that can protect you and your family

Understand your net worth and cash flow needs, both today and in the future

Explore how your wealth grows over time under different scenarios

Explore ways to transfer wealth efficiently according to your wishes

Identify opportunities to optimize your investment strategy

ACTIVE MANAGEMENT ACROSS ASSET CLASSES

Arlington Capital Partners offers regional and global high-active-share equities, fixed income across the yield curve, liquidity solutions backed by four decades of experience as a core capability and, in

private markets, real estate, infrastructure, private equity and private debt. Beyond investment management, Arlington Capital Partners provides engagement in equity and bond markets, proxy voting and policy advocacy.

HOW WE WORK

Outstanding team

Arlington Capital Partners is a tightly knit group working together with management teams toward common goals. We have more than 70 investment professionals, including 24 partners with an average tenure at Arlington Capital Partners of more than a decade. This allows us to devote substantial time to the companies in which we invest.

Collaborative style

Our objective is to work with portfolio company leadership and create a backdrop in which companies can thrive. We encourage management teams to invest alongside us, and our forward-thinking approach and philosophy to leave companies better than when we found them also means that portfolio company employees often choose to invest alongside Arlington Capital Partners as well.

Alignment of interest

We believe that people thrive when they are working toward a common and focused goal. We are proud of our transparency and alignment of interest with our portfolio companies and investors. We believe our focus and significant skin in the game allows us to build true, successful partnerships.

$649B AUM

We continue to build on our track record to innovate into new strategies, drive growth, and serve our investors.

Environment

Our Buyout Funds’ portfolio can be qualified as ‘asset light’ and the most material environmental indicator for many companies is electricity usage.

Social

processes and practices are in place across the portfolio to support the wellbeing of the workforce.

Governance

good corporate governance and a code of ethics which guides our business activities is the foundation of effective corporate management.

LIVE LONGER, BETTER.

What is long-term care? Long-term care is something that most people may not think they need, or might think is covered by health insurance or Medicare. The fact is, if you live to be 65, there’s a 70% chance you’ll eventually need some kind of long-term care.1 But aging isn’t the only reason to plan for long-term care—it’s there for you if a chronic illness or disabling injury prevents you from living on your own or properly caring for yourself, no matter how old you are. Long-term care helps with day-to-day tasks like bathing, eating,

getting dressed, and getting in and out of bed. And it includes care provided by nursing homes, assisted living facilities, adult day care centers, hospice facilities, and skilled nurses or home health aides in your (or your loved one’s) home. If you’re not the one who needs it, there’s a good chance you’ll need to help care for a loved one.2 And having a long-term care plan in place can help you continue to live well without sacrificing the income, investments, and savings you’ve worked so hard for.

Our People

We focus on attracting exceptionally talented people and rewarding initiative, independent thinking and integrity. Our team’s breadth of skills and deep expertise are a critical source of intellectual capital.

Our Scale

Investing across regions, industries and asset classes gives us the knowledge, resources and critical mass to take advantage of opportunities on a global scale.

Our Performance

Our performance is characterized by superior risk-adjusted returns across a broad and expanding range of asset classes and through all types of economic conditions.